Debt collection has always been a challenging part of business operations, especially for industries like financing, fintech, e-commerce, and public services. Without the right tools, unpaid bills can quickly pile up, hurting cash flow and straining customer relationships.

But now, thanks to debt collection with AI technology, companies can transform the way they manage overdue payments—making the process faster, smarter, and more customer-friendly.

What is AI-Powered Debt Collection?

This technology leverages Artificial Intelligence (AI) to automate interactions with customers. It can:

- Call customers via voicebots or message them through chatbots

- Understand and respond using natural language processing (NLP)

- Offer flexible payment options based on each customer’s situation

- Log and analyze conversations for future insight

In short, it eliminates the need for large manual collection teams while delivering faster and more scalable results.

Real-Life Simulation: A Conversational Debt Collection with AI in Action

In a recent simulation, an AI voicebot contacted a customer about an unpaid balance of Rp1,200,000:

“Good morning, I’m calling from BFI. I’d like to discuss your payment of Rp1,200,000. Do you have a plan to settle it?��

When the customer responded that they had no money yet, the AI didn’t pressure or threaten. Instead, it offered options:

“We can assist you with payment scheduling or installment plans. Would you like to discuss the available options?”

The customer eventually agreed to a monthly installment of Rp100,000—achieved entirely through a polite and empathetic conversation with AI.

Why Use AI in Debt Collection?

Adopting an AI-based debt collection solution brings multiple advantages:

1. Operational Efficiency

- Automates hundreds or thousands of calls simultaneously

- Cuts down on the need for large call center teams

2. Improved Customer Experience

- The AI uses a respectful, helpful tone

- Customers feel heard and are more willing to cooperate

3. Flexibility and Personalization

- Tailored messaging and options based on customer behavior

- Payment plans offered based on historical data

4. Data-Driven Decision Making

- Every interaction is recorded and analyzed

- Insights help refine future collection strategies

Use Case: Leasing and Fintech Sectors

Financing companies and fintech lenders often deal with large customer volumes and varying payment behaviors. Manual collection simply can’t scale.

With automated debt collection software, they can:

- Reduce DPD (Days Past Due) across customer segments

- Improve recovery rates from delinquent accounts

- Decrease the burden on human agents by up to 40%

Is It Time to Upgrade Your Collection System?

If your company is dealing with any of the following, it’s time to consider automation:

- High volumes of overdue payments

- Low response rates from customers

- Ballooning collection costs

- Unmet monthly recovery targets

AI-based solutions don’t just speed up your operations—they transform the entire customer lifecycle approach, turning collections into meaningful conversations.

Why Callindo?

Callindo is your trusted partner in AI-driven customer experience, offering a fully customizable debt collection system built for scale and performance.

What we offer:

- Proven AI and automation solutions

- Seamless omnichannel integration (voice, chat, WhatsApp, SMS)

- Custom workflows by industry

- Expert support and secure infrastructure

We help you focus your human resources where it matters most—on complex or high-risk cases—while letting AI handle the routine tasks.

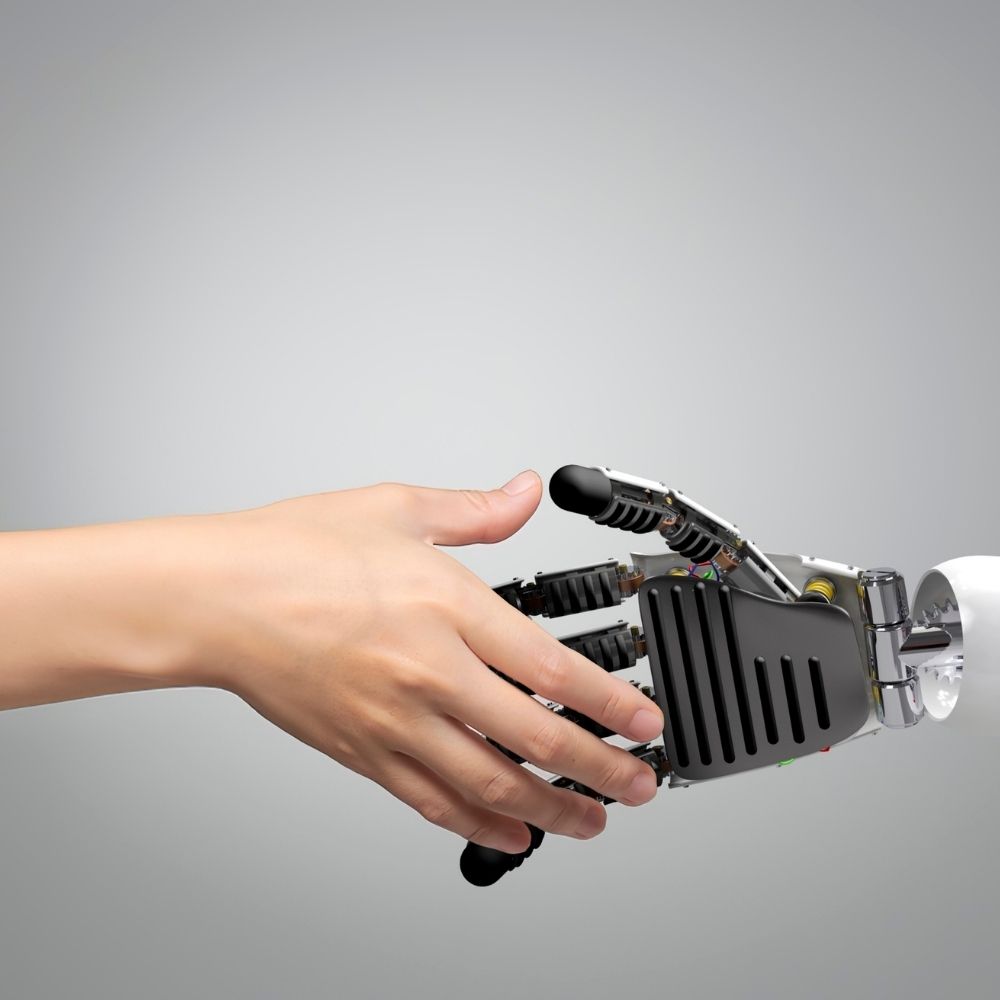

The Future is Now: Human-AI Collaboration in Debt Collection

AI isn’t here to replace people—it’s here to empower them. The ideal model is a hybrid collection system where:

- AI handles first-level conversations and filtering

- Complex cases are escalated to human agents

- All data is synced into a central system for better decision-making

This synergy increases productivity, reduces costs, and keeps customer satisfaction high—even in challenging financial situations.

Conclusion: Debt Collection, But Smarter

Forget the outdated image of debt collection as confrontational and inefficient. With AI-powered debt collection, your company can:

- Shorten collection cycles

- Recover more with less effort

- Build long-term customer trust

Technology has changed the game—and it’s time you joined in. Make your collections work smarter, not harder.